The Middle East in 2018 should be the hottest area for cross-border e-commerce in the world. The United States is engaged in trade wars with China,, and it has begun to impose consumption tax across the state; Europe's VAT regulation is becoming more and more strict. The e-commerce dividend period has begun to fade.Southeast Asia has no money, and the market is consumed by some companies. So everyone agreed to turn their attention to the Middle East where the local tyrants gathered. Especially after the emergence of a unicorn like Jollychic, everyone firmly believed that the Middle East is a blue ocean of cross-border e-commerce.

Thanks to its strong spending power, the idea of accepting new things and the good infrastructure for e-commerce development, the speed of the Gulf countries is the highest in the world. Retailers in the Gulf countries are also changing in the new wave of e-commerce to gain greater benefits.

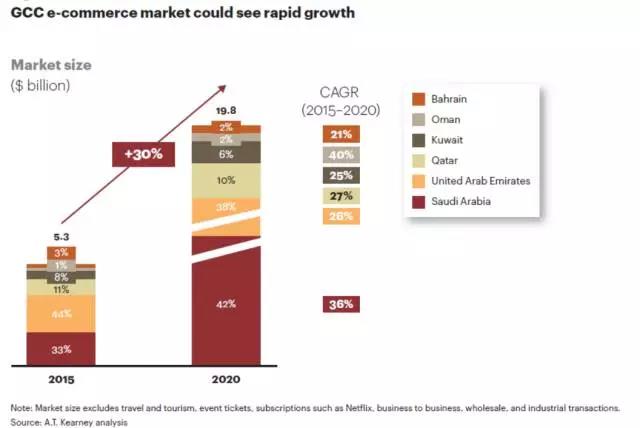

Despite having good infrastructure, the e-commerce promotion path in the Gulf countries is still difficult. The per capita GDP of the Gulf countries is the highest in the world. Many residents have a large disposable income. The UAE’s smartphone penetration rate is 70%-80%. The Saudi and UAE smartphone usage rates are 57% and 69% respectively. In addition, more than Two-thirds of the residents of the Gulf countries use the Internet, and the network coverage of Bahrain and Qatar is over 90%. However, the e-commerce market in the Gulf countries is unusually small,which compared with countries who are similar economic conditions, per capita GDP, and Internet penetration rates. Kearney Consulting's statistics show that the e-commerce market in the Gulf countries in 2015 was only 5.3 billion US dollars, accounting for only 0.4% of the Gulf countries' GDP.

There are several obstacles to the development of the e-commerce market in the Gulf countries: consumers have insufficient knowledge and trust in e-commerce; There are more restrictions in payment, distribution and logistics ; local government's policy on e-commerce is not clear. For example, residents of the Gulf States prefer cash payments: 67% of transactions in Saudi Arabia and 58% of transactions in the UAE are traded in cash. Behind the high cash usage rate, there is a lack of alternative payment methods for cash payments, and consumers are also dissatisfied with other existing payment methods.

According to the survey, more than half of Saudi nationals are dissatisfied with payment methods such as debit/credit cards, mobile payment apps and sales terminals. Interestingly, more than half of Saudi nationals are dissatisfied with cash payments, but cash payments still act as a monopoly in local payment methods.

In addition, information security and fraud are also more concerned by consumers. Norton's report shows that 40% of consumers in the Middle East and North Africa who use mobile phones have experienced cybercrime.

In the UAE, only about 50% of Internet users have heard of e-commerce platforms. The small number of products types and quantities on the e-commerce platform , the lack of interest of local retailers in developing e-commerce are also the reasons for why consumers' lack of understanding in e-commerce platforms. At the same time, experienced shoppers are more inclined to choose an international shopping platform that offers more choices and more convenient shopping experience.

In terms of payment, the banking and debit/credit card penetration rates of the entire Gulf countries are not high. For example, in Saudi Arabia, about 50% of people do not use banking, and the debit/credit card penetration rate is only 40% - compared with 80% of banking and credit/debit card penetration rates in developed countries. There is a big gap.

In terms of distribution, most retailers in the Gulf countries do not have enough warehouses to meet the fast delivery that consumers expect (within 24 hours). Kearney's analysis shows that in the Gulf countries, only less than half of the top retailers offering e-commerce who have their own regional distribution centers, so that they need to import more goods, which also leads to higher air freight costs. The lack of postal code in the Gulf States has exacerbated this problem, which causing logistics companies become confused during the final delivery. In addition, the small number of parcels and the lack of courier companies also lead to higher final delivery costs.

The government's policy on e-commerce is still in the exploration stage, so that retailers' cross-border market operations less efficient. Taxes, especially the ambiguity of tariffs, have led to delays in consumer access to products and rising costs on cross-border transactions. There is no protection measures related to distribution and product quality for shopping disputes so it affects retailers and consumers.

The Kearney report shows that compared with 58% of the US, only 34% of the major retailers in the Gulf countries have e-commerce platforms. However, in a suitable development environment, the e-commerce market in the Gulf countries is expected to be the existing market in 2020. Four times the size, reaching $20 billion (see image below). Among them, the average annual growth rate of e-commerce is as high as 30%, far exceeding the average annual growth rate of 9% in the traditional retail industry.

There are three main factors contributing to the development of e-commerce in the Gulf countries: consumers have a higher awareness of e-commerce, higher online conversion rates and more retail companies to provide e-commerce channels.

For example, the pure online shopping platform Souq.com has invested heavily in improving its level as an e-commerce platform and overcoming obstacles to e-commerce development in the Middle East.

More funds invested in the e-commerce platform also indicate that investors are optimistic about the development potential of e-commerce in the region. In March 2017, Amazon acquired Souq for $650 million, fashion retailer Namshi raised $35 million, and online shopping community MarkaVIP raised more than $20 million – all of which put the money into logistics operations and other areas. . As the importance of traditional retailers declines, the rapid growth of e-commerce is at the expense of sharing traditional retailers.

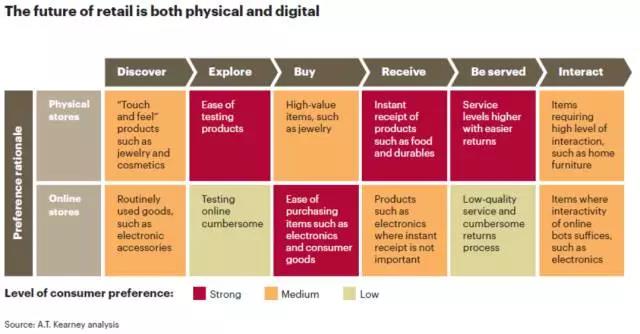

Although traditional retailers have been slow to respond to the rapid development of e-commerce, traditional retail companies may dominate the e-commerce campaign in the next five years, and omni-channel development is their magic weapon. Kearney Consulting has studied the behavior of American consumers and found that 55% of consumers are shopping online, which means that future consumption will not be overly dependent on online platforms, but offline. Combined with offline – retail companies can take advantage of this and better leverage their strengths.

However, omni-channel development is not the exclusive magic weapon for offline retailers. Several online retailers have begun to enter the line: global online retail giant Amazon opened an offline retail store in Seattle in 2015 . Amazon plans to expand to California and other places in the future. Eyewear e-commerce Warby Parker opened eight offline retail stores in 2013 and 2014 to showcase their own products and facilitate consumer online shopping to pick up the goods. Surprisingly, Warby Parker's sales per square foot is similar to Tiffany's, which is 2.5 times that of Best Buy.

For retailers in Gulf countries, the success of omni-channel retail depends on how their online store experience, whether they provide good payment mechanisms, and how much they invest in distribution and infrastructure. In addition, they need to work with Gulf governments to reduce policy bottlenecks that hinder the development of cross-border e-commerce.

E-commerce companies that have already entered the Middle East know that logistics channels and payment are still very headaches. First of all, the UAE has no major problems, but Saudi Arabia’s customs clearance is very difficult. the cost of compliance is very high. Basically, every product must have SASO certification. Secondly, there are more prohibited items than other regions. Moreover, most of the e-commerce goods in Saudi Arabia are sent in the form of small packets. The route is rather tortuous.

It’s hard to get to the local area, and the delivery of the last mile is not satisfactory. Due to the low penetration rate of e-commerce, customers in the Middle East prefer to use COD (cash on delivery) settlement.

If e-commerce wants to develop rapidly, it must vigorously promote popular online payment, and increase investment in logistics to solve the problem of low sign-off yield and slow return. In the choice of logistics service providers, they can combine their own goods characteristics. select. At present, there are many logistics brands in the Middle East, and each has its own strengths. There are local logistics brands aramex, Q Express, Fetchr, local logistics undertake more than 80% of the goods transport; there are also logistics service companies from China, but in view of the difficult logistics delivery in the Middle East, it is best to choose to have experience in the Middle East and have a certain government The service provider of the relationship, thus reducing the various obstacles encountered in customs clearance and distribution.

Based on more than ten years of intensive work in the Middle East, CITITRANS won the Dubai Government's Smart Services Award for M-Token Services Award in 2017 and launched cross-border e-commerce logistics services 、 e-commerce on the basis of traditional logistics、Value-added services.We currently have the SOUQ investment agency rights. In the future, CITITRANS will provide a large number of high-quality Chinese sellers with comprehensive services such as opening sales channels, full-chain logistics and distribution, customer service and returning to the second shelf.

CITITRANS INTERNATIONAL LOGISTICS GROUP focus on cross-border integrated logistics services in emerging countries. The services cover the whole chain of international freight forwarding, FCL,LCL, air transportation to the door and cross-border e-commerce logistics. The core advantage of CITITRANS is the localization operation of the destination countries. It not only has its own operation team in the Middle East, Mexico, Kenya, and Southeast Asia, but also has e-commerce overseas warehouses, terminal delivery and bilingual customer service teams. In the whole process of logistics services, we can control quality and timeliness, and provide our customers with the best service.